News

2024

July 22, 2023

Mississauga: Cargojet Inc. (“Cargojet” or the “Corporation”) (TSX:CJT) announced the successful retainment of its ISO 9001:2015 Quality Standard Accreditation, for the twenty-second consecutive year. Cargojet is the only air cargo carrier in Canada with this accreditation.

“This accreditation reinforces Cargojet’s commitment to providing customers with high-quality, safe, reliable, and timely service daily. It involves reviewing the organization’s documented quality management system and conducting ongoing audits of our facilities to ensure that the quality management systems are effectively implemented,” says Jamie Porteous, Co-CEO.

“We have retained this certification thanks to the dedicated efforts of our team, who consistently exceed our customers’ expectations while upholding excellence in standards, processes, and procedures,” remarks Pauline Dhillon, Co-CEO.

Cargojet is Canada’s leading provider of time-sensitive, premium air cargo services to all major cities across North America, providing Dedicated, ACMI and International Charter services, and carries over 25,000,000 pounds of cargo weekly. Cargojet operates its network with its own fleet of 41 aircraft.

For further information, please contact investor relations at investorrelations@cargojet.com

Notice on Forward-Looking Statements:

Certain statements contained herein constitute “forward-looking statements”. Forward-looking statements look into the future and provide an opinion as to the effect of certain events and trends on the business. Forward-looking statements may include words such as “plans,” “intends,” “anticipates,” “should,” “estimates,” “expects,” “believes,” “indicates,” “targeting,” “suggests” and similar expressions. These forward-looking statements are based on current expectations and entail various risks and uncertainties. Reference should be made to the issuer’s most recent Annual Information Form filed with the Canadian securities regulators, and its most recent Annual Consolidated Financial Statements and Quarterly Financial Statements and Notes thereto and related Management’s Discussion and Analysis (MD&A), for a summary of major risks. Actual results may materially differ from expectations, if known and unknown risks or uncertainties affect our business, or if our estimates or assumptions prove inaccurate.

The issuer assumes no obligation to update or revise any forward-looking statement, whether as a result of new information, future events or any other reason, other than as required by applicable securities laws. In the event the issuer does update any forward- looking statement, no inference should be made that the issuer will make additional updates with respect to that statement, related matters, or any other forward-looking statement.

Mississauga, Ontario, July 3, 2024 – Cargojet Inc. (TSX:CJT), a leader in the air cargo industry, today announced that it will release its financial results for the second quarter ended June 30, 2024, on Tuesday, August 13, 2024 after market close.

Jamie Porteous, Co-CEO, Pauline Dhillon, Co-CEO, Scott Calver, CFO, Sanjeev Maini, Vice President Finance of Cargojet will host a conference call on Wednesday, August 14, 2024, at 8:30 a.m. Eastern Time to discuss results.

To participate in this conference call, please dial the following number(s) approximately five minutes prior to the commencement of the call:

Local Number: 416 340 2217

Toll-Free Number (Canada/US): 1 800 806 5484

Participant Passcode: 8549928#

Should you be unable to participate, an instant replay will be available until

September 11th, 2024, 23:59 by dialing:

Local Number: 905 694 9451

Toll-Free Number (Canada/US): 1 800 408 3053

Access Code: 7911675#

For any one-on-one calls please contact Scott Calver to coordinate timing.

We look forward to having you participate in our call.

For Additional Information please contact: Investorrelations@cargojet.com

Mississauga, ON, June 10, 2024—Cargojet (TSX:CJT) announced today that it has entered into a three-year agreement with China-based Great Vision HK Express to provide scheduled charter services—from Hangzhou, China to Vancouver, B.C., and from Vancouver, B.C. to Hangzhou, China—utilizing B767-300F aircraft.

Servicing the rapidly expanding Chinese e-Commerce sector, Cargojet will operate a minimum of three flights per week and began service on May 22, 2024, with eight flights successfully completed to date. Total revenue for this program is estimated at over CAD $160M for the full term of the agreement.

“Leveraging Cargojet’s industry-leading record of on-time performance and reliability, together with the connection opportunities from Vancouver to fifteen other cities in Canada, will allow Great Vision HK to provide enhanced services for China-based e- Commerce service providers, to their customers across Canada,” said Jamie B. Porteous, Co-Chief Executive Officer.

“We continue to explore opportunities to maximize asset and aircraft utilization and look forward to a strong partnership with Great Vision HK,” added Pauline Dhillon, Co-Chief Executive Officer.

Christine Cheng, co-founder and Chief Operating Officer at Great Vision HK, said: “This is an important milestone for Great Vision HK, and we’ve partnered with Cargojet, another industry-leader in Canada, to provide top-quality transportation services to our customers in Asia.”

Great Vision HK provides its customers with China-to-Canada-to-China end-to-end integrated logistics supply chain solutions, including pick up, pre-sorting, international air freight, customs clearance, distribution, last-mile delivery and after-sales services.

“International air freight is a key part of this logistical chain, and we believe through this strategic partnership with Cargojet that we can offer extremely reliable and efficient services to our customers, while continuing to promote trade between the two countries,” Cheng said.

Cargojet is Canada’s leading provider of time-sensitive, premium air cargo services to all major cities across North America, providing Dedicated, ACMI and International Charter services, and carries over 25,000,000 pounds of cargo weekly. Cargojet operates its network with its own fleet of 41 aircraft.

For further information, please contact investor relations at investorrelations@cargojet.com

For more information about Great Vision, email harrison.huang@great-vision.ca

Notice on Forward-Looking Statements:

Certain statements contained herein constitute “forward-looking statements”. Forward-looking statements look into the future and provide an opinion as to the effect of certain events and trends on the business. Forward-looking statements may include words such as “plans,” “intends,” “anticipates,” “should,” “estimates,” “expects,” “believes,” “indicates,” “targeting,” “suggests” and similar expressions. These forward-looking

statements are based on current expectations and entail various risks and uncertainties. Reference should be made to the issuer’s most recent Annual Information Form filed with the Canadian securities regulators, and its most recent Annual Consolidated Financial Statements and Quarterly Financial Statements and Notes thereto and related Management’s Discussion and Analysis (MD&A), for a summary of major risks. Actual results may materially differ from expectations, if known and unknown risks or uncertainties affect our business, or if our estimates or assumptions prove inaccurate. The issuer assumes no obligation to update or revise any forward-looking statement, whether as a result of new information, future events or any other reason, other than as required by applicable securities laws. In the event the issuer does update any forward- looking statement, no inference should be made that the issuer will make additional updates with respect to that statement, related matters, or any other forward-looking statement.

Mississauga, ON, May 15, 2024 – the Board of Directors of Cargojet Inc. (“Cargojet” or the “Corporation”) (TSX:CJT) has declared a cash dividend of $0.3146 per common voting share and variable voting share for the period from April 1, 2024 to June 30, 2024. The record date for determining shareholders of the Corporation entitled to receive payment of the dividend of the Corporation shall be June 20, 2024 and the payment date for such dividend shall be on or before July 5, 2024. These dividends will be eligible dividends within the meaning of the Income Tax Act (Canada).

Cargojet is Canada’s leading provider of time sensitive premium air cargo services to all major cities across North America, providing Dedicated, ACMI and International Charter services and carries over 25,000,000 pounds of cargo weekly. Cargojet operates its network with its own fleet of 41 aircraft.

For further information, please contact investor relations at investorrelations@cargojet.com

Notice on Forward Looking Statements:

Certain statements contained herein constitute “forward-looking statements”. Forward-looking statements look into the future and provide an opinion as to the effect of certain events and trends on the business. Forward-looking statements may include words such as “plans,” “intends,” “anticipates,” “should,” “estimates,” “expects,” “believes,” “indicates,” “targeting,” “suggests” and similar expressions. These forward-looking statements are based on current expectations and entail various risks and uncertainties. Reference should be made to the issuer’s most recent Annual Information Form filed with the Canadian securities regulators, and its most recent Annual Consolidated Financial Statements and Quarterly Financial Statements and Notes thereto and related Management’s Discussion and Analysis (MD&A), for a summary of major risks. Actual results may materially differ from expectations, if known and unknown risks or uncertainties affect our business, or if our estimates or assumptions prove inaccurate. The issuer assumes no obligation to update or revise any forward-looking statement, whether as a result of new information, future events or any other reason, other than as required by applicable securities laws. In the event the issuer does update any forward-looking statement, no inference should be made that the issuer will make additional updates with respect to that statement, related matters, or any other forward-looking statement.

March 25, 2024

Mississauga, ONT – Cargojet Inc (“Cargojet or the Corporation” (TSX:CJT)) in conjunction with the release of its First quarter results, will host a conference call at 8:30 a.m. Eastern Standard Time (5:30 a.m. Pacific Daylight Time) on Monday, April 29th, 2024. The first quarter will be released, prior to the market opening on Monday, April 29th, 2024.

The financial results will be released by newswire as well as filed with SEDAR. The results will also be available on our website.

Ajay K. Virmani, Executive Chairman, Jamie Porteous Co-CEO, Pauline Dhillon Co-CEO, Scott Calver, CFO Sanjeev Maini, Vice President Finance of Cargojet will review first quarter financial results and corporate developments.

To participate in this conference call, please dial the following number(s) approximately five minutes prior to the commencement of the call:

Local Number: 416 340 2217

Toll-Free Number (Canada/US): 1 800 806 5484

Participant Passcode: 5679065#

Should you be unable to participate, an instant replay will be available until

Tuesday, May 28th, 2024, 23:59 by dialing:

Local Number: 905 694 9451

Toll-Free Number (Canada/US): 1 800 408 3053

Access Code: 3146612#

For any one-on-one calls please contact Scott Calver to coordinate timing.

We look forward to having you participate in our call.

For Additional Information please contact: Investorrelations@cargojet.com

Mississauga, ON, March 8, 2024 – the Board of Directors of Cargojet Inc. (“Cargojet” or the “Corporation”) (TSX:CJT) has declared a cash dividend of $0.3146 per common voting share and variable voting share for the period from January 1, 2024 to March 31, 2024. The record date for determining shareholders of the Corporation entitled to receive payment of the dividend of the Corporation shall be March 20, 2024 and the payment date for such dividend shall be on or before April 5, 2024. These dividends will be eligible dividends within the meaning of the Income Tax Act (Canada).

Cargojet is Canada’s leading provider of time sensitive premium air cargo services to all major cities across North America, providing Dedicated, ACMI and International Charter services and carries over 25,000,000 pounds of cargo weekly. Cargojet operates its network with its own fleet of 41 aircraft.

For further information, please contact investor relations at investorrelations@cargojet.com

Notice on Forward Looking Statements:

Certain statements contained herein constitute “forward-looking statements”. Forward-looking statements look into the future and provide an opinion as to the effect of certain events and trends on the business. Forward-looking statements may include words such as “plans,” “intends,” “anticipates,” “should,” “estimates,” “expects,” “believes,” “indicates,” “targeting,” “suggests” and similar expressions. These forward-looking statements are based on current expectations and entail various risks and uncertainties. Reference should be made to the issuer’s most recent Annual Information Form filed with the Canadian securities regulators, and its most recent Annual Consolidated Financial Statements and Quarterly Financial Statements and Notes thereto and related Management’s Discussion and Analysis (MD&A), for a summary of major risks. Actual results may materially differ from expectations, if known and unknown risks or uncertainties affect our business, or if our estimates or assumptions prove inaccurate. The issuer assumes no obligation to update or revise any forward-looking statement, whether as a result of new information, future events or any other reason, other than as required by applicable securities laws. In the event the issuer does update any forward-looking statement, no inference should be made that the issuer will make additional updates with respect to that statement, related matters, or any other forward-looking statement.

MISSISSAUGA, ON, FEBRUARY 12, 2024 – Cargojet Inc. (“Cargojet” or the “Corporation”) (TSX: CJT) announced today that the annual general meeting of shareholders (the “Meeting”) will be held at the Cargojet Offices – 2281 North Sheridan Way, Mississauga, Ontario. The meeting will be held on Thursday, April 11th, 2024 at 11:30 a.m. EST.

Cargojet is Canada’s leading provider of time sensitive premium air cargo services to all major cities across North America and select international destinations, providing dedicated, ACMI, CMI and international charter services and carries over 25,000,000 pounds of cargo weekly. Cargojet operates it network with its own fleet of 41 aircraft.

For additional information, please contact:

January 24, 2024

Mississauga, ONT – Cargojet Inc. in conjunction with the release of its Fourth Quarter and Year End 2023 Financial Results, will host a conference call at 8:30a.m. Eastern Standard Time (5:30a.m. Pacific Daylight Time) on Monday February 26, 2024. Fourth quarter and Year End 2023 results will be released, prior to the market opening on Monday, February 26, 2024. The financial results will be released by newswire as well as filed with SEDAR. The results will also be available on our website.

Ajay K. Virmani, Executive Chairman, Jamie Porteous Co-CEO, Pauline Dhillon Co-CEO, Scott Calver, CFO Sanjeev Maini, Vice President Finance of Cargojet will review fourth quarter financial results and corporate developments.

To participate in this conference call, please dial the following number(s) approximately five minutes prior to the commencement of the call:

Local Number: 416 340 2217

Toll Free Number: 1 800 806 5484

Participant Passcode: 8673249#

Should you be unable to participate, an instant replay will be available until

Tuesday, March 26, 2024 by dialing:

Local Number: 905 694 9451

Toll Free Number: 1 800 408 3053

Access Code: 4705863#

For any one-on-one calls please contact Scott Calver to coordinate timing. We look forward to having you participate in our call.

For Additional Information please contact:

MISSISSAUGA, ON, January 15, 2024 – Cargojet Inc. (“Cargojet” or the “Corporation”) today provided an update on its ongoing efforts to further streamline its fleet strategy and the associated impacts to capital expenditures and cashflows.

“Throughout 2023 we exercised caution in deploying growth capital given the softer economic conditions” said Dr. Ajay Virmani, Executive Chairman, “Forecasts continue to indicate that the international air cargo market will remain soft in the short to medium term and deploying B-777s into the market would not be strategically prudent. We have decided to exit our commitments for the four remaining B-777 aircraft, while continuing to flex our B767 fleet to accommodate our organic growth strategy”, noted Dr. Virmani. “Cargojet has substantially completed the operational groundwork to be able to enter the B-777 market should economic conditions change. Cargojet has also retained the rights to provide the optionality for future conversion slots”.

“The holiday season performance for 2023 was in line with our expectations” noted Jamie Porteous, Co-Chief Executive Officer. “With our optimized fleet strategy and cost efficiencies gained throughout 2023, we are well positioned to deliver strong cashflows and shareholder value” commented Pauline Dhillon, Co-Chief Executive Officer.

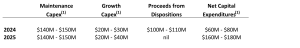

As a further update to the above comment, the Corporation is providing the following estimated capital expenditures targets for the years ending December 31, 2024 and 2025 (see “Notice on Forward-Looking Statements” below):

Cargojet is not expecting to incur any meaningful Growth Capital Expenditures in 2024. However, the Corporation continues to monitor macro-economic conditions for opportunities to deploy capital if profitable growth opportunities emerge in the future.

Cargojet will continue with a disciplined approach to capital allocation, focusing on four key principles;

1. Maintain dividend growth;

2. Continue to identify growth opportunities to deploy capital that meet its margin requirements;

3. Maintain a share buyback program under its normal course issuer bid (“NCIB”). The Corporation will determine the ultimate size of the buyback program based on available growth opportunities and subject to market conditions; and

4. Target Net Debt to Adjusted EBITDA Leverage Ratio(1) of 1.5x to 2.5x (2022 Leverage Ratio of 2.1).

Under its NCIB, the Corporation has purchased for cancellation an aggregate of 366,408 voting shares as at December 31, 2023 for an average purchase price of $104.66, at a total cost of $38.3 million.

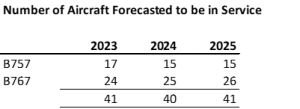

The table below sets forth the Corporation’s cargo operating fleet as at December 31, 2023 as well as the expected operating fleet requirements for the next two years (see “Notice on Forward-Looking Statements” below):

As previously disclosed, the Corporation has four surplus B757 freighters and is exploring options such as dry lease or ultimate sale of these aircraft. The potential sale of these four B757’s is not anticipated to have a material impact on Revenues and/or Adjusted EBITDA(1). In the event that the Corporation enters into a leasing agreement, the Revenue and Adjusted EBITDA would increase in accordance with typical market terms and conditions for similar aircraft. The fleet table above assumes two aircraft are dry leased and the remaining two B757’s are sold.

Cargojet currently owns the feedstock for two B767’s and plans to convert them as the demand begins to recover over the next couple of years. Management believes that the current fleet plan will be sufficient to meet its short to medium-term objectives and Cargojet is well positioned to scale up operations as the economic cycle returns to growth.

All references to “$” in this press release are to Canadian dollars.

(1) Adjusted EBITDA, Growth Capital Expenditures, Maintenance Capital Expenditures, Net Capital Expenditures and Net Debt to Adjusted EBITDA Leverage Ratio are non-GAAP measures and ratios. See “Non-GAAP Financial Measures” below.”

Notice on Forward-Looking Statements:

Implicit in forward-looking statements in respect of Cargojet’s expectations for the Corporation’s capital expenditure plans for 2024 and 2025 as described above are certain current assumptions, including assumptions regarding the Corporation’s expectations for proceeds from aircraft dispositions and resulting Net Capital Expenditures, the expected operating fleet as described above (including plans for the four surplus B757 freighters and conversion feedstock for two B767’s), expectations regarding the international air cargo market remaining soft in the short to medium term, the continuation of the Corporation’s long-term contracts with key customers and on-time performance; the continued diversification of the Corporation’s service offerings and demand for such offerings; the Corporation’s expectations for long-term e-commerce growth trends; the availability of debt financing; availability of unrestricted air space; the availability of jet fuel at costs within historical trends; an average currency exchange rate of $1.35 per U.S. dollar in 2023-2026. The Corporation may review and revise its outlook and capital expenditure plans as economic, geopolitical, market and regulatory environments change.

In addition, forward-looking statements in this press release, including in respect of expected operating fleet and associated impacts to capital expenditures, are based on current expectations and entail various risks and uncertainties. There can be no assurances regarding (a) credit, market, currency, commodity market, inflation, interest rates, global supply chains, operational, and liquidity risks generally; (b) geopolitical events; and (c) other risks inherent to Cargojet’s business and/or factors beyond its control which could have a material adverse effect on the Corporation.

Reference should be made to the Corporation’s public filings available at www.sedar.com and at www.cargojet.com, including its most recent Annual Information Form filed with the Canadian securities regulators, its most recent Annual Consolidated Financial Statements and Notes thereto and related Management’s Discussion and Analysis (“MD&A”), for a summary of material risks. These risks are not intended to represent a complete list of the risks that could affect the Corporation; however, these risks should be considered carefully. Actual results may materially differ from expectations, if known and unknown risks or uncertainties affect our business, or if our estimates or assumptions prove inaccurate. The forward-looking statements contained herein describe the Corporation’s expectations as of the date of this news release and are subject to change after such date. However, Cargojet disclaims any intention or obligation to update or revise any forward-looking statements whether because of new information, future events or otherwise, except as required under applicable securities regulations.

Non-GAAP Financial Measures

Below is a description of certain non-GAAP financial measures and non-GAAP financial ratios used by the Corporation to provide readers with additional information on its financial and operating performance. Non-GAAP financial ratios are ratios or percentages that are calculated using a non-GAAP financial measure. Such measures are not recognized measures for financial statement presentation under GAAP, do not have standardized meanings, may not be comparable to similar measures presented by other entities and should not be considered a substitute for or superior to GAAP results.

“Adjusted EBITDA” is defined as earnings before share-based compensation, interest, taxes, depreciation, amortization, and other adjustments. Adjusted EBITDA is calculated as net income or loss excluding the following: depreciation, aircraft heavy maintenance amortization, contract asset amortization, unrealized gains or losses on fair value of cash settled share based payment arrangement, swaps and warrants, realized gain or losses on settlement of swaps, interest on long-term debt, deferred income taxes, provision for current income taxes, gain or loss on disposal of property, plant and equipment, impairment of property plant and equipment, unrealized foreign exchange gains or losses, gains or losses on settlement of debts or finance lease liabilities, share based compensation and provision for employee pension. For a reconciliation of historical Adjusted EBITDA, please refer to page 15 of our annual MD&A.

“EBITDA” is defined as earnings before interest, taxes, depreciation and amortization. EBITDA is calculated as net income or loss excluding the following: depreciation, and aircraft heavy maintenance amortization, interest on long-term debt, deferred income taxes and provision for current income taxes. For a reconciliation of historical EBITDA, please refer to page 15 of our annual MD&A.

“Growth Capital Expenditures” (or “Growth Capex”) are defined as discretionary investments of the Corporation to increase capacity, geographic reach and to acquire more customers with a purpose to grow operational revenue, profits and cash flows.

“Maintenance Capital Expenditures” (or “Maintenance Capex”) are defined as any fixed assets acquired during a reporting period to maintain the Corporation aircraft fleet and other assets at the level required to continue operating the existing business. They also include any capital expenditure required to extend the operational life of the fleet including heavy maintenance. Maintenance capital expenditures exclude any capital expenditures that result in new and additional capacity required to grow operational revenue and cash flows. For historical Growth Capital Expenditures and Maintenance Capital Expenditures, please refer to page 15 of our annual MD&A.

“Net Capital Expenditures” are defined as Growth Capital Expenditures plus Maintenance Capital Expenditures less proceeds from dispositions of owned or leased aircraft, commitments to convert aircraft.

“Net Debt to Adjusted EBITDA Leverage Ratio” (or “Leverage Ratio”) is a measure of our level of financial leverage and is obtained by dividing Net Debt by Adjusted EBITDA and is measure of the Corporation’s ability to meet its financial obligations. Net Debt is a metric obtained by subtracting cash from debt and lease liabilities and is used to monitor the Corporation’s financial leverage. For a historical calculation of Net Debt, please refer to page 28 of our annual Consolidated Financial Statements.

About Cargojet

Cargojet is Canada’s leading provider of time sensitive premium air cargo services to all major cities across North America, providing Dedicated, ACMI and International Charter services and carries over 25,000,000 pounds of cargo weekly. Cargojet operates its network with its own fleet of 41 aircraft.

For further information, please contact investor relations at investorRelations@cargojet.com

2023

Mississauga, ON, December 29, 2023 – Cargojet Inc. (“Cargojet” or the “Corporation”) (TSX: CJT) announced today (the “Redemption Date”) that it has redeemed the $86,250,000 aggregate principal amount outstanding on its 5.75% senior unsecured hybrid debentures due April 30, 2024. The Corporation paid the principal amount and all accrued and unpaid interest up to, but excluding, the Redemption Date, in cash.

About Cargojet

Cargojet is Canada’s leading provider of time sensitive premium air cargo services to all major cities across North America, providing dedicated, ACMI and international charter services and carries over 25,000,000 pounds of cargo weekly. Cargojet operates its network with its own fleet of 39 cargo aircraft.

For further information, please contact:

Pauline Dhillon

Chief Corporate Officer

Tel: (905) 501-7373

pdhillon@cargojet.com

Renewed Partnership to Increase Cargo Capacity in Canada’s Arctic

December 27, 2023

Mississauga, Ontario – Cargojet, Canada’s leading provider of air cargo services, and Canadian

North, the Arctic’s leading airline, today unveiled a renewed cargo partnership aimed at increasing capacity to better serve Canada’s Arctic. The renewal deepens a 20-year relationship, furthering their joint mission to connect and support remote and northern communities.

The renewed partnership signifies a major increase in cargo capacity, a strategic move by Cargojet and Canadian North to address the rapidly growing needs of Canada’s Arctic. This expansion will enable more frequent and efficient deliveries, ensuring that remote and northern communities in Canada’s Arctic have reliable access to essential supplies.

Under the renewed partnership, Cargojet will be the exclusive provider for air cargo from Winnipeg and Ottawa to Iqaluit, while Canadian North will continue to deliver air cargo across Canada’s Arctic. This builds upon Canadian North’s recent announcement to double the size of its cargo facility in Ottawa by 2026, which not only serves as an integral gateway for Inuit communities but also underscores its unwavering commitment to expanding services in the Arctic.

“Maintaining and strengthening relationships is crucial, especially when it comes to serving our communities,” said Shelly De Caria, Canadian North’s President and CEO. “With Cargojet’s expertise, we are continuing to combine our strengths to be able to provide faster, more reliable deliveries of essential supplies to our northern communities, creating opportunities for local businesses to grow, and ensuring that people up North have access to the goods they rely on.”

“Cargojet has been a long-time provider of dedicated and essential air cargo services to Iqaluit for Canadian North and its customers,” stated Dr. Ajay K. Virmani, Cargojet’s President and CEO. “Cargojet’s enviable track record of on-time performance and reliability will ensure that essential goods are delivered on-time to the people of Nunavut. We are very pleased to enter into this new long-term commitment with our partners at Canadian North,” he concluded.

Together, Cargojet and Canadian North are committed to fostering prosperity in Canada’s Arctic by advancing the well-being of Inuit communities through a strengthened partnership dedicated to efficient and reliable cargo transportation.

______________________________________________

Media Contact

|

Annie Thomlinson, Manager, Communications (343) 551-0294 |

Pauline Dhillon, Chief Corporate Officer (905) 501-7373 |

__________________________________________

Quick Facts

- Cargojet and Canadian North have been partners for more than 22 years.

- This renewed partnership extends a longstanding relationship by another 5 years.

- Every year, Cargojet assists Canadian North in flying over 10.6 million kilograms of cargo, which is equivalent to approximately 1,000 polar bears.

- Canadian North serves as an integral gateway to Inuit communities, facilitating essential cargo transportation to these remote regions. Many of these communities lack year-round land or marine access to the rest of the country, making air transport a vital lifeline for their needs.

- As an Inuit-owned airline, Canadian North is committed to supporting its northern communities through reduced fares and discounted cargo rates for country food, snowmobiles, and ATVs to all Inuit land claim agreement beneficiaries in Nunavik, Nunavut, and the Northwest Territories.

About Canadian North

Canadian North is a 100% Inuit-owned airline that connects people and delivers essential goods throughout Canada’s North – safely, reliably and always with friendly and caring customer service. Canadian North Airlines services 25 communities within the Northwest Territories, Nunavik and Nunavut, along with Ottawa, Montreal, Edmonton, Calgary, and now extending its service to Nuuk, Greenland through an interline partnership with Air Greenland – with a versatile fleet of Boeing 737, ATR 42 and ATR 72 Freighter aircraft. Canadian North is also the premier charter services provider for large resource sector clients requiring dependable, efficient and economical fly-in/fly-out air service and it operates flights across North America and beyond for sports teams, cruise lines, tour operators and many others. Canadian North is wholly owned by Makivik Corporation and Inuvialuit Development Corporation.

About Cargojet

Cargojet is Canada’s leading provider of time sensitive overnight air cargo services and carries over 1,000,000 pounds of cargo each business night. Cargojet operates its network across North America, utilizing a fleet of all-cargo aircraft. For more information, please visit: www.cargojet.com.

Notice on Forward Looking Statements:

Certain statements contained herein constitute “forward-looking statements”, including with respect to the Corporation’s intention to purchase Shares under the NCIB and ASPP, as described above, and the timing and benefits of such purchases. Forward-looking statements look into the future and provide an opinion as to the effect of certain events and trends on the business. Forward-looking statements may include words such as “plans,” “intends,” “anticipates,” “should,” “estimates,” “expects,” “believes,” “indicates,” “targeting,” “suggests” and similar expressions. These forward-looking statements are based on current expectations and entail various risks and uncertainties. Reference should be made to the Corporation’s most recent Annual Information Form filed with the Canadian securities regulators, and its most recent Consolidated Financial Statements and Notes thereto and related Management’s Discussion and Analysis (MD&A), for a summary of major risks. Actual results may materially differ from expectations, if known and unknown risks or uncertainties affect our business, or if our estimates or assumptions prove inaccurate. The forward-looking statements contained or incorporated by reference in this news release represent Cargojet’s expectations as of the date of this news release (or as of the date they are otherwise stated to be made) and are subject to change after such date. However, Cargojet disclaims any intention or obligation to update or revise any forward-looking statements whether because of new information, future events or otherwise, except as required under applicable securities laws. In the event Cargojet does update any forward-looking statement, no inference should be made that Cargojet will make additional updates with respect to that statement, related matters, or any other forward-looking statement.

The TSX has not reviewed and does not accept responsibility for the adequacy or accuracy of this statement.

Mississauga, ON, November 14, 2023 – Cargojet Inc. (“Cargojet” or the “Corporation”) (TSX: CJT) today announced its intention to redeem in full on December 29, 2023 (the “Redemption Date”) all of its then-outstanding 5.75% senior unsecured hybrid debentures due April 30, 2024 (the “Debentures”) in accordance with the provisions of the indenture (the “Indenture”) dated November 6, 2018 between the Corporation and Computershare Trust Company of Canada (the “Trustee”).

The redemption price (the “Redemption Price”) for the Debentures will be 100% of the aggregate outstanding principal amount, together with accrued and unpaid interest up to, but excluding, the Redemption Date. In accordance with the Indenture, Cargojet intends to satisfy its obligation to pay the Redemption Price in cash. Interest upon the entire aggregate principal amount of the Debentures will cease to be payable from and after the Redemption Date. The Corporation intends to draw approximately $90 million under its non-revolving delayed-draw term loan facility and use such funds to redeem the Debentures. In the 15 business days preceding the scheduled Redemption Date of December 27, 2023, the Trustee is not required to transfer or exchange any Debentures.

The Debentures are listed on the TSX under the symbol “CJT.DB.D” and will be delisted from the facilities of the Toronto Stock Exchange in connection with the redemption of the Debentures. The 5.75% senior unsecured hybrid debentures due April 30, 2025 and the 5.25% senior unsecured hybrid debentures due June 30, 2026 remain outstanding and continue to be listed on the TSX under the symbols “CJT.DB.E” and “CJT.DB.F”, respectively.

About Cargojet

Cargojet is Canada’s leading provider of time sensitive premium air cargo services to all major cities across North America, providing dedicated, ACMI and international charter services and carries over 25,000,000 pounds of cargo weekly. Cargojet operates its network with its own fleet of 39 cargo aircraft.

For further information, please contact:

Pauline Dhillon

Chief Corporate Officer

Tel: (905) 501-7373

Notice on Forward Looking Statements:

Certain statements contained herein constitute “forward-looking statements”, including with respect to the Corporation’s intention to redeem all of its then-outstanding Debentures, as described above, and the timing and benefits of such redemption. Forward-looking statements look into the future and provide an opinion as to the effect of certain events and trends on the business. Forward-looking statements may include words such as “plans,” “intends,” “anticipates,” “should,” “estimates,” “expects,” “believes,” “indicates,” “targeting,” “suggests” and similar expressions. These forward-looking statements are based on current expectations and entail various risks and uncertainties. Reference should be made to the Corporation’s most recent Annual Information Form filed with the Canadian securities regulators, and its most recent Consolidated Financial Statements and Notes thereto and related Management’s Discussion and Analysis (MD&A), for a summary of major risks. Actual results may materially differ from expectations, if known and unknown risks or uncertainties affect our business, or if our estimates or assumptions prove inaccurate. The forward-looking statements contained or incorporated by reference in this news release represent Cargojet’s expectations as of the date of this news release (or as of the date they are otherwise stated to be made) and are subject to change after such date. However, Cargojet disclaims any intention or obligation to update or revise any forward-looking statements whether because of new information, future events or otherwise, except as required under applicable securities laws. In the event Cargojet does update any forward-looking statement, no inference should be made that Cargojet will make additional updates with respect to that statement, related matters, or any other forward-looking statement.

The TSX has not reviewed and does not accept responsibility for the adequacy or accuracy of this statement.

Mississauga, ON, November 13, 2023 – Cargojet Inc. (“Cargojet” or the “Corporation”) (TSX: CJT) is pleased to announce a significant leadership transition. Effective January 1, 2024, Pauline Dhillon, currently serving as Chief Corporate Officer, and Jamie Porteous, currently Chief Strategy Officer, will be appointed Co-Chief Executive Officers (Co-CEOs) and Dr. Ajay Virmani, currently serving as CEO, will be appointed Executive Chairman.

Pauline Dhillon and Jamie Porteous have been integral executive members of the Cargojet team since its inception 22 years ago. Their commitment, extensive industry knowledge, and visionary leadership have played pivotal roles in Cargojet’s growth and success.

“We are pleased to announce the appointment of Pauline Dhillon and Jamie Porteous as Co-CEOs of Cargojet,” said Dr. Ajay Virmani, Executive Chairman. “Their complementary skillset, long-standing dedication to our organization along with unwavering focus on our team, customers, and stakeholders makes them the ideal strategic successors to lead us into a new era of innovation and growth while continuing to provide a seamless service to our customers”.

This strategic decision reflects our confidence in these talented individuals who, working collaboratively, have been instrumental in shaping Cargojet’s journey and further reinforces our commitment to provide the highest level of service and reliability to our customers.

As Co-CEOs, Pauline Dhillon and Jamie Porteous will continue to work hand-in-hand and drive the company’s vision, mission, and strategic initiatives, ensuring that Cargojet remains at the forefront of the air cargo industry while upholding the core values and culture.

Pauline Dhillon is a founding member of the Cargojet team and has been with the company from Day One. Pauline has been an integral part of Cargojet’s growth journey over the past 22 years and over this period, she has led several functions with increasing responsibility including Marketing, Brand, Government Relations, Human Resources, Legal, Facilities, Operational Efficiency and Commercial operations, leading up to her current role as Chief Corporate Officer. Pauline currently oversees all aspects of support functions as well as ground operations globally.

Jamie B. Porteous is also a founding member of the Cargojet team and has been with the company from Day One. Jamie also has been an integral part of Cargojet’s growth journey over the past 22 years and has been instrumental in helping grow Cargojet from a startup to the air-cargo leader. Jamie has served in many roles including Sales, Customer Relations, Commercial Strategy, Operations, Network Planning and Design, and Investor Relations, and more recently as the Chief Strategy Officer.

“We are excited and humbled by this opportunity,” remarked Pauline Dhillon. “Our focus remains on safely delivering excellence in air cargo solutions for our customers while staying true to our corporate culture and founding principles. Teamwork by our dedicated professionals prides itself on putting customers first in everything we do at Cargojet.”– Pauline Dhillon

Jamie Porteous added, “Cargojet’s legacy is built on innovation and a relentless commitment to reliability and outstanding customer service. We are fully committed to continue to provide long-term value to our customers, our shareholders and to our employees.”

Cargojet looks forward to the continued support of our valued customers, partners, and stakeholders as we embark on this new chapter in our journey. Together, with Pauline Dhillon and Jamie Porteous at the helm, we are confident in our ability to set new standards and reach even greater heights in the air cargo industry.

About Cargojet

Cargojet is Canada’s leading provider of time-sensitive premium air cargo services to all major cities across North America, providing Dedicated, ACMI and International Charter services and carries over 25,000,000 pounds of cargo weekly. Cargojet operates its network with a fleet of over 40 aircraft. For further information, please contact:

Pauline Dhillon

Chief Corporate Officer

Tel: (905) 501 7373

pdhillon@cargojet.com

Mississauga, ON, November 13, 2023 – Cargojet Inc. (“Cargojet” or the “Corporation”) (TSX: CJT) Board of Directors is pleased to announce a significant leadership transition. After launching Cargojet 22 years ago as Founder and Chief Executive Officer, Dr. Ajay Virmani will be stepping into the role of Executive Chairman effective January 1, 2024 and the Corporation has announced leadership appointments in a separate announcement. This strategic move reflects Dr. Virmani’s dedication to the company’s long-term success and the need to ensure a seamless transition in the leadership.

Dr. Ajay Virmani, who has served as the CEO since its inception in 2001, along with the team he built, has been instrumental in Cargojet’s remarkable journey from a start-up to Canada’s #1 cargo airline. Just last week Dr. Virmani was appointed to the Order of Ontario. The Globe and Mail honored Dr. Virmani as the CEO-Strategist of the year in 2020. In 2004, Dr. Virmani was awarded the “Entrepreneur of the Year award” by Ernst &Younge. Recognizing his entrepreneurial and philanthropic contribution to Canada, he was inducted into Canada’s Walk of Fame with his own star in 2021. Cargojet and its leadership has also been recognized as the 50 Best Managed Companies by Deloitte’s and has been a consistent winner of Canada’s Best Cargo Airline award 21 years running.

Under Dr. Virmani’s visionary and entrepreneurial leadership, the company operates a fleet of over 40 Aircraft and consistently posted remarkable financial results. Cargojet has grown its revenues at 16% and EBITDA at 20% compound annual rate over the past 20 years. The world’s top courier brands, integrators, freight forwarders and E-Commerce platforms have partnered with Cargojet to fulfil their middle-mile air requirements. Cargojet’s shareholder have been handsomely rewarded with 18%* compound annual return since its IPO in 2005.

In Dr. Virmani’s new role as Executive Chairman, he will continue to play a pivotal role in shaping the company’s future. He will focus on Strategy, Strategic Customer Partnerships, Acquisitions of major Assets including aircraft and Corporate Governance while also acting as a mentor for emerging talent. This transition allows Dr. Virmani to leverage his extensive experience and deep industry knowledge to guide the board and senior leadership team.

“Everything we have done at Cargojet has been against odds. Starting an airline after 9/11; Convincing global package delivery brands that it is more efficient to abandon their own aircraft fleets in favour of Cargojet’s network; Surviving the 2007-08 global financial crisis, and more recently tackling once in a 100-year pandemic.” said Dr. Ajay Virmani. “As I look back at the Cargojet journey, I am filled with gratitude for the opportunity to work with an amazing team of dedicated and hard-working professionals who have built Cargojet into Canada’s #1 Cargo Airline. I am looking forward to the opportunity to continue to serve as Executive Chairman of this great team and help develop the next generation of leaders who will continue to beat the odds.” Concluded Dr. Virmani.

“We are extremely grateful to Dr Virmani for his vison, passion and contributions towards the tremendous success Cargojet has achieved. The transition to Executive Chairman by Dr. Virmani is a testament to his unwavering commitment to Cargojet, its excellent team and its potential. The Company remains committed to providing world class Cargo services safely while exceeding customer expectations,” said Paul Godfrey Interim Chair of the Board on behalf of all the Directors.

The Board of Directors and the entire Cargojet family extend their heartfelt appreciation to Dr. Virmani for his outstanding leadership as a Founder and CEO and they look forward to his continued guidance in his new role as Executive Chairman, confident that this transition will mark a new chapter in Cargojet’s ongoing success story.

About Cargojet

Cargojet is Canada’s leading provider of time sensitive premium air cargo services to all major cities across North America, providing Dedicated, ACMI and International Charter services and carries over 25,000,000 pounds of cargo weekly. Cargojet operates its network with a fleet of over 40 aircraft. For further information, please contact:

Pauline Dhillon

Chief Corporate Officer

Tel: (905) 501 7373

*As at November 1, 2023

Mississauga, ON, Nov 7, 2023 – the Board of Directors of Cargojet Inc. has declared a cash dividend of $0.3146 per common voting share and variable voting share for the period from October 1, 2023, to December 31, 2023, an increase of $0.0286 or 10.0% per share from the previous quarter.

“This increase in the cash dividend reinforces our commitment to return value to our shareholders,” said Dr. Ajay Virmani, President and Chief Executive Officer. “It is also consistent with our capital allocation plan to periodically increase cash returns to our shareholders”, he added.

The dividends will be paid to all shareholders of record as at the close of business on December 20, 2023, and will be payable on or before January 5, 2024. These dividends will be eligible dividends within the meaning of the Income Tax Act (Canada).

Cargojet is Canada’s leading provider of time sensitive premium air cargo services to all major cities across North America, providing Dedicated, ACMI and International Charter services and carries over 25,000,000 pounds of cargo weekly. Cargojet operates its cargo network with its own fleet of 39 aircraft.

For further information, please contact:

Pauline Dhillon

Chief Corporate Officer

Tel: (905) 501 7373

pdhillon@cargojet.com

Notice on Forward Looking Statements:

Certain statements contained herein constitute “forward-looking statements”, including with respect to the Corporation’s intention to reduce planned capital expenditures and operating costs, to strengthen strategic customer relationships, Forward-looking statements look into the future and provide an opinion as to the effect of certain events and trends on the business. Forward-looking statements may include words such as “plans,” “intends,” “anticipates,” “should,” “estimates,” “expects,” “believes,” “indicates,” “targeting,” “suggests” and similar expressions. These forward-looking statements are based on current expectations and entail various risks and uncertainties. Reference should be made to the issuer’s most recent Annual Information Form (AIF) filed with the Canadian securities regulators, and it’s most recent Annual Consolidated Financial Statements and Notes thereto and related Management’s Discussion and Analysis (MD&A), for a summary of major risks. Actual results may materially differ from expectations, if known and unknown risks or uncertainties affect our business, or if our estimates or assumptions prove inaccurate. The Corporation cautions that the list of risk factors and uncertainties described in the AIF and MD&A is not exhaustive and other factors could also adversely affect its results. Readers are urged to consider the risks, uncertainties and assumptions carefully in evaluating the forward-looking information and are cautioned not to place undue reliance on such information. The forward-looking information contained herein represents our expectations as of the date hereof (or as the date they are otherwise stated to be made), and are subject to change after such date. However, we disclaim any intention or obligation or undertaking to update or revise any forward-looking information whether as a result of new information, future events or otherwise, except as required under applicable securities laws. In the event the issuer does update any forward-looking statement, no inference should be made that the issuer will make additional updates with respect to that statement, related matters, or any other forward-looking statement.

Mississauga, ON, November 7, 2023 – Cargojet Inc. (“Cargojet” or the “Corporation”) (TSX:CJT) today announced that the Toronto Stock Exchange (“TSX”) has accepted its notice of intention to proceed with a normal course issuer bid (“NCIB”) for a portion of its common voting shares and variable voting shares (together, the “Shares”).

The Corporation has implemented the NCIB in respect of the Shares because it believes that, from time to time over the next 12 months, the market price of the Shares may not fully reflect the underlying value of the Shares and that at such times the purchase of the Shares would be in the best interests of the Corporation. Any purchases made under the NCIB, which will begin on November 9, 2023, and end no later than November 8, 2024, are made by Cargojet subject to favourable market conditions at the prevailing market price at the time of acquisition through the facilities of the TSX and/or alternative Canadian trading systems.

Pursuant to the notice, Cargojet intends to purchase up to 1,500,000 Shares (the “Aggregate Limit”), during the twelve-month period commencing November 9, 2023, and ending November 8, 2024. The Corporation may fulfill such Aggregate Limit by the repurchase of the Shares as appropriate opportunities arise from time to time. The Corporation intends to acquire up to a maximum of 1,500,000 Shares, representing approximately 8.72% of its outstanding Shares. As at November 6, 2023, there were 17,209,499 Shares outstanding. Under the NCIB, other than purchases made under block purchase exemptions, Cargojet may purchase up to 12,076 Shares on the TSX during any trading day, which represents approximately 25% of the average daily trading volume, as calculated in accordance with TSX rules. Any Shares purchased under the NCIB will be cancelled.

In connection with the NCIB, the Corporation entered into an automatic share purchase plan (“ASPP”) with a designated broker. Pursuant to the ASPP, the Corporation has instructed the designated broker to make purchases under the NCIB in accordance with the terms of the ASPP. Such purchases will be determined by the designated broker at its sole discretion based on purchasing parameters set by Cargojet in accordance with the rules of the TSX, applicable securities laws and the terms of the ASPP. The ASPP has been pre-cleared by the TSX and will be implemented today. All purchases made under the ASPP will be included in computing the number of Shares purchased under the NCIB.

About Cargojet

Cargojet is Canada’s leading provider of time sensitive premium air cargo services to all major cities across North America, providing dedicated, ACMI and international charter services and carries over 25,000,000 pounds of cargo weekly. Cargojet operates its network with its own fleet of 39 cargo aircraft.

For further information, please contact:

Pauline Dhillon

Chief Corporate Officer

Tel: (905) 501-7373

Notice on Forward Looking Statements:

Certain statements contained herein constitute “forward-looking statements”, including with respect to the Corporation’s intention to purchase Shares under the NCIB and ASPP, as described above, and the timing and benefits of such purchases. Forward-looking statements look into the future and provide an opinion as to the effect of certain events and trends on the business. Forward-looking statements may include words such as “plans,” “intends,” “anticipates,” “should,” “estimates,” “expects,” “believes,” “indicates,” “targeting,” “suggests” and similar expressions. These forward-looking statements are based on current expectations and entail various risks and uncertainties. Reference should be made to the Corporation’s most recent Annual Information Form filed with the Canadian securities regulators, and its most recent Consolidated Financial Statements and Notes thereto and related Management’s Discussion and Analysis (MD&A), for a summary of major risks. Actual results may materially differ from expectations, if known and unknown risks or uncertainties affect our business, or if our estimates or assumptions prove inaccurate. The forward-looking statements contained or incorporated by reference in this news release represent Cargojet’s expectations as of the date of this news release (or as of the date they are otherwise stated to be made) and are subject to change after such date. However, Cargojet disclaims any intention or obligation to update or revise any forward-looking statements whether because of new information, future events or otherwise, except as required under applicable securities laws. In the event Cargojet does update any forward-looking statement, no inference should be made that Cargojet will make additional updates with respect to that statement, related matters, or any other forward-looking statement.

The TSX has not reviewed and does not accept responsibility for the adequacy or accuracy of this statement.

Mississauga, ON, November 7, 2023 – Cargojet Inc. (“Cargojet” or the “Corporation”) (TSX:CJT) announced today financial results for the third quarter ended September 30, 2023.

Total Revenues for the quarter were $214.0 million compared to third quarter 2022 Revenues of $232.7 million. Revenues, excluding fuel, was $177.7 million compared to $175.6 million. Adjusted EBITDA for the quarter was $70.0 million compared to the third quarter 2022 Adjusted EBITDA of $82.1 million. Net earnings for the quarter was $10.5 million (net loss of $6.8 million excluding warrant valuation gain) compared to net earnings of $83.4 million in 2022 (net loss of $1.9 million excluding warrant valuation gain).

Strong cash flow focus generated an Adjusted Free Cash Flow(1) of $94.5 million for the three-month period ended September 30, 2023 compared to $47.9 million for the same period in 2022. Net cash generated from operating activities of $39.4 million for the three-month period ended September 30, 2023, compared to $77.9 million for the same period in 2022.

“Higher interest rates are starting to impact the household disposable incomes and we are observing a division in household spending. The volumes for discretionary items are softening but the volumes for essential household goods are holding up well. A positive revenue growth in this environment demonstrates the resilience of our diversified business model.” said Dr. Ajay Virmani, President and CEO.

“We are prudently trimming capital expenditures and the entire Cargojet team is diligently working on identifying every cost saving opportunity. As we further sharpen our operating model, we are squarely focused on strengthening our relationships with strategic customers by meeting their changing needs and delivering the industry best on-time performance,” noted Dr. Virmani. “Our on-time performance was 99.5% in the Quarter thanks to the dedication, professionalism and hard work of the entire Cargojet team”.

As announced in a separate press release issued today, the Corporation has implemented a normal course issuer bid (“NCIB”) in respect of its common voting shares and variable voting shares (together, the “Shares”) because it believes that, from time to time over the next 12 months, the market price of the Shares may not fully reflect the underlying value of the Shares and that at such times the purchase of the Shares would be in the best interests of the Corporation. Any purchases made under the NCIB, which will begin on November 9, 2023, and end no later than November 8, 2024, are made by Cargojet subject to favourable market conditions at the prevailing market price at the time of acquisition through the facilities of the TSX and/or alternative Canadian trading systems.

All references to “$” in this press release are to Canadian dollars.

About Cargojet

Cargojet is Canada’s leading provider of time sensitive premium air cargo services to all major cities across North America, providing Dedicated, ACMI and International Charter services and carries over 25,000,000 pounds of cargo weekly. Cargojet operates its network with its own cargo fleet of 39 aircraft. For further information, please contact:

Pauline Dhillon

Chief Corporate Officer

Tel: (905) 501 7373

(1) Non-GAAP Measures

“Adjusted EBITDA” and “Adjusted Free Cash Flow” are non-GAAP measures used by the Corporation to provide additional information on its financial and operating performance. Adjusted EBITDA and Adjusted Free Cash Flow are not recognized measures for financial statement presentation under International Financial Reporting Standards (“IFRS”) and it does not have standardized meanings and may not be comparable to similar measures presented by other public companies.

Adjusted EBITDA is used by the Corporation to assess earnings before interest, taxes, depreciation, amortization, gain or loss on disposal of capital assets, unrealized foreign exchange gains or losses, unrealized gain or loss on forward foreign exchange contracts, aircraft heavy maintenance amortization, contract asset amortization, gain or loss on cash settled share based payment arrangement related to a financing arrangement, unrealized gain or loss on fair value of total return swap related to a financing arrangement, gain or loss on fair value of stock warrant, loss on settlement of cash settled share based payment arrangement related to a financing arrangement, gain on settlement of total return swap related to a financing, loss on extinguishment of debts, and non-cash employee pension expense, as these costs can vary significantly among airlines due to differences in the way airlines finance their aircraft and other assets. The most directly comparable financial measure disclosed in the Corporation’s financial statements is net earnings.

Adjusted Free Cash Flow is calculated as Standardized Free Cash Flow, as defined by CPA Canada, less operating cash flows provided from or used in discontinued operations, changes in working capital, plus the provision for current income taxes. The most directly comparable financial measure disclosed in the Corporation’s financial statements is net cash generated from operating activities.

Standardized Free Cash Flow is defined as “Cash flows from operating activities” as reported in the IFRS financial statements, including operating cash flows provided from or used in discontinued operations; total maintenance capital expenditures minus proceeds from the disposition of capital assets other than those of discontinued operations, as reported in the IFRS financial statements; and dividends, when stipulated, unless deducted in arriving at cash flows from operating activities.

Reconciliation of non-IFRS measures, including Adjusted EBITDA and Adjusted Free Cash Flow, is provided below and in the “Non-GAAP Measures” section on page 13 of the Corporation’s Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) for the three month period ended September 30, 2023 and is available on SEDAR at www.sedar.com.

|

CALCULATION OF EBITDA, ADJUSTED EBITDA, FREE CASH FLOW AND ADJUSTED FREE CASH FLOW |

||

|

(Canadian dollars in millions, except where indicated) |

||

|

|

Three Month Period Ended |

|

|

|

September 30, |

|

|

|

2023 |

2022 |

|

|

(unaudited) |

(unaudited) |

|

Calculation of EBITDA and Adjusted EBITDA |

|

|

|

Net earnings |

$10.5 |

$83.4 |

|

Add: |

|

|

|

Interest |

16.2 |

7.4 |

|

Provision of deferred taxes |

(0.5) |

1.9 |

|

Depreciation of property,plant and equipment |

46.6 |

35.7 |

|

EBITDA (1) |

72.8 |

128.4 |

|

Add: |

|

|

|

Share-based compensation |

2.4 |

5.0 |

|

Gain on sale of property,plant and equipment |

2.0 |

(0.1) |

|

Loss (gain) on swap derivative |

6.8 |

(6.1) |

|

Unrealized foreign exchange gain |

1.6 |

2.6 |

|

Fair value adjustment on warrant valuation and amortization of contract assets |

(15.3) |

(48.8) |

|

Share of (gain) loss of associate |

(0.3) |

1.1 |

|

Adjusted EBITDA (1) |

70.0 |

82.1 |

|

Calculation of Standardized Free Cash Flow and Adjusted Free Cash Flow |

||

|

NET CASH GENERATED FROM OPERATING ACTIVITIES |

39.4 |

77.9 |

|

Less: Maintenance capital expenditures (1) |

(25.1) |

(34.2) |

|

Add: Proceeds from disposal of property,plant and equipment |

59.3 |

0.1 |

|

Standardized free cash flow (1) |

73.6 |

43.8 |

|

Changes in non-cash working capital items and deposits |

20.9 |

4.1 |

|

Adjusted free cash flow (1) |

$94.5 |

$47.9 |

- EBITDA, Adjusted EBITDA, Adjusted Free Cash Flow, Standardized Free Cash Flow and Maintenance Capital Expenditure are non-IFRS financial measures and are not earning measures recognized by IFRS. Please refer to Page 15 of Cargojet’s MD&A for a more detailed discussion.

Notice on Forward Looking Statements:

Certain statements contained herein constitute “forward-looking statements”, including with respect to the Corporation’s intention to reduce planned capital expenditures and operating costs, to strengthen strategic customer relationships, and to purchase Shares under the NCIB, including the timing and benefits of such purchases. Forward-looking statements look into the future and provide an opinion as to the effect of certain events and trends on the business. Forward-looking statements may include words such as “plans,” “intends,” “anticipates,” “should,” “estimates,” “expects,” “believes,” “indicates,” “targeting,” “suggests” and similar expressions. These forward-looking statements are based on current expectations and entail various risks and uncertainties. Reference should be made to the issuer’s most recent Annual Information Form (AIF) filed with the Canadian securities regulators, and it’s most recent Annual Consolidated Financial Statements and Notes thereto and related Management’s Discussion and Analysis (MD&A), for a summary of major risks. Actual results may materially differ from expectations, if known and unknown risks or uncertainties affect our business, or if our estimates or assumptions prove inaccurate. The Corporation cautions that the list of risk factors and uncertainties described in the AIF and MD&A is not exhaustive and other factors could also adversely affect its results. Readers are urged to consider the risks, uncertainties and assumptions carefully in evaluating the forward-looking information and are cautioned not to place undue reliance on such information. The forward-looking information contained herein represents our expectations as of the date hereof (or as the date they are otherwise stated to be made), and are subject to change after such date. However, we disclaim any intention or obligation or undertaking to update or revise any forward-looking information whether as a result of new information, future events or otherwise, except as required under applicable securities laws. In the event the issuer does update any forward-looking statement, no inference should be made that the issuer will make additional updates with respect to that statement, related matters, or any other forward-looking statement.

|

|

Selected Financial Information and Operating Statistics Highlights |

|

|||||||||

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial Information and Operating Statistics Highlights |

|

|

|

|

|

|

|||||

|

(Canadian dollars in millions, except where indicated) |

|

|

|

|

|

||||||

|

|

|

|

Three Month Period Ended |

|

Nine month Ended |

||||||

|

|

|

|

September 30, |

|

September 30, |

||||||

|

|

|

|

2023 |

2022 |

Change |

% |

|

2023 |

2022 |

Change |

% |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Domestic network, ACMI and charter revenues |

|

$177.7 |

$175.6 |

$2.1 |

1.2% |

|

$519.2 |

$532.4 |

($13.2) |

-2.5% |

|

|

Fuel surcharge and other revenues |

|

$36.3 |

$57.1 |

($20.8) |

-36.4% |

|

$136.4 |

$180.5 |

($44.1) |

-24.4% |

|

|

Total revenues |

|

$214.0 |

$232.7 |

($18.7) |

-8.0% |

|

$655.6 |

$712.9 |

($57.3) |

-8.0% |

|

|

Direct expenses |

|

$180.5 |

$175.1 |

$5.4 |

3.1% |

|

$534.0 |

$527.3 |

$6.7 |

1.3% |

|

|

Gross margin |

|

$33.5 |

$57.6 |

($24.1) |

-41.8% |

|

$121.6 |

$185.6 |

($64.0) |

-34.5% |

|

|

Gross margin – (%) |

|

15.7% |

24.8% |

-9.1% |

|

|

18.5% |

26.0% |

-7.5% |

|

|

|

Selling, general and administrative expenses |

|

$15.2 |

$13.4 |

$1.8 |

13.4% |

|

$47.4 |

$44.2 |

$3.2 |

7.2% |

|

|

Net finance costs and other gains and losses |

|

$8.6 |

($42.2) |

$50.8 |

120.4% |

|

($1.1) |

($70.8) |

$69.7 |

98.4% |

|

|

Share of (gain) loss of associate |

|

($0.3) |

$1.1 |

($1.4) |

-127.3% |

|

($0.1) |

$2.3 |

($2.4) |

-104.3% |

|

|

Earnings before income taxes |

|

$10.0 |

$85.3 |

($75.3) |

-88.3% |

|

$75.4 |

$209.9 |

($134.5) |

-64.1% |

|

|

Income taxes |

|

($0.5) |

$1.9 |

($2.4) |

126.3% |

|

$3.2 |

$22.1 |

($18.9) |

-85.5% |

|

|

Net earnings |

|

$10.5 |

$83.4 |

($72.9) |

-87.4% |

|

$72.2 |

$187.8 |

($115.6) |

-61.6% |

|

|

Earnings (loss) per share |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$0.61 |

$4.84 |

($4.23) |

-87.4% |

|

$4.20 |

$10.86 |

($6.66) |

-61.3% |

|

|

Diluted |

|

$0.61 |

$4.33 |

($3.72) |

-85.9% |

|

$3.99 |

$9.82 |

($5.83) |

-59.4% |

|

|

Adjusted |

|

$0.30 |

$2.18 |

($1.88) |

-86.2% |

|

$2.20 |

$6.00 |

($3.80) |

-63.3% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA (2) |

|

$72.8 |

$128.4 |

($55.6) |

-43.3% |

|

$245.1 |

$331.0 |

($85.9) |

-26.0% |

|

|

EBITDA margin (2)– (%) |

|

34.0% |

55.2% |

-21.2% |

|

|

37.4% |

46.4% |

-9.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA (2) |

|

$70.0 |

$82.1 |

($12.1) |

-14.7% |

|

$219.3 |

$246.1 |

($26.8) |

-10.9% |

|

|

Adjusted EBITDA margin (2)– (%) |

|

32.7% |

35.3% |

-2.6% |

|

|

33.5% |

34.5% |

-1.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted free cash flow (2) |

|

$94.5 |

$47.9 |

$46.6 |

97.3% |

|

$189.4 |

$131.8 |

$57.6 |

43.7% |

|

|

Operating statistics (3) |

|

|

|

|

|

|

|

|

|

|

|

|

Operating days (4) |

|

50 |

50 |

– |

– |

$0.0 |

149 |

149 |

– |

– |

|

|

Average domestic network revenue per operating day (5) |

|

1.78 |

1.84 |

(0.06) |

-3.3% |

0.00 |

1.70 |

1.77 |

(0.07) |

-4.0% |

|

|

Block hours (6) |

|

16,472 |

18,067 |

(1,595) |

-8.8% |

0 |

51,121 |

53,640 |

-2,519 |

-4.7% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B757-200 |

|

15 |

12 |

3 |

|

|

15 |

12 |

3 |

|

|

|

B767-200 |

|

3 |

2 |

1 |

|

|

3 |

2 |

1 |

|

|

|

B767-300 |

|

21 |

18 |

3 |

|

|

21 |

18 |

3 |

|

|

|

Cargo operating fleet |

|

39 |

32 |

7 |

21.9% |

0.0 |

39 |

32 |

7 |

21.9% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Head count |

|

1808 |

1718 |

90 |

5.2% |

0.0 |

1808 |

1718 |

90 |

5.2% |

- Adjusted EPS is not an earning measure recognized by IFRS and is defined as earnings per share from continuing operations before fair value increase (decrease) on stock warrant, losses (gains) on swap derivatives, amortization on stock warrants and unrealized foreign exchange losses (gains).

- EBITDA, Adjusted EBITDA and Adjusted Free Cash Flow are non-GAAP financial measures and are not earning measures recognized by IFRS. Prior year amounts have been restated to reflect the revised definitions of Adjusted EBITDA. Please refer to the “Non-GAAP measures” section on page 13 of this MD&A for a more detailed discussion and a reconciliation of these non-GAAP financial measures to the nearest GAAP measure.

- The definitions for the Operating statistics included in this table are provided in the notes below.

- Operating days refer to the Company’s domestic network air cargo network operations that run primarily on Monday to Friday with a reduced network operating on Friday.

- Average domestic network revenue per operating day refers to total domestic network revenues earned by the Company per operating day.

- Block hours refers to the total duration of a flight from the time the aircraft releases its brakes when it initially moves from the airport parking area prior to flight, to the time the brakes are set when it arrives at the airport parking area after the completion of the flight.`

October 19, 2023

Mississauga, – Cargojet has recently renewed its International Air Transport Association (IATA) Operational Safety Audit (IOSA) registration. IOSA is an internationally recognized and accepted evaluation system designed to assess the operational management and control systems of an airline. IOSA uses internationally recognized quality audit principles to conduct audits in a standardized and consistent manner.

IATA’s mission is to represent, lead and serve the airline industry. Its approximately 300 airline members account for 83 percent of total air traffic. Cargojet is very proud to be the only Canadian all-cargo carrier that is a full member of IATA.

“The audit is an in-depth look at the practices and standards of the airline with the end goal of meeting a common, worldwide standard for safety in everything we do, our audit team has once again done a tremendous job in working with the auditors to demonstrate conformance with IOSA standards” according to Dr. Ajay K. Virmani, President & CEO. “We fully support the continuous updating of standards to reflect regulatory revisions and the evolution of best practices within the worldwide airline industry under the continuing stewardship of IATA”, adds Virmani.

We want to recognize and thank our team of dedicated professionals for their continuous efforts, hard work, and dedication to Cargojet.

Cargojet is a global leading provider of time-sensitive premium overnight air cargo services and carries over 1,300,000 pounds of cargo each business night. Cargojet operates its network across North America each business night serving 15 major cities, and selected international destinations, utilizing a fleet of 37 all-cargo aircraft.

For further information, please contact: Pauline Dhillon

Chief Corporate Officer Tel: (905) 501-7373

October 4, 2023

Mississauga, ONT – Cargojet Inc. (TSX: CJT.UN) in conjunction with the release of its Third Quarter Financial Results, will host a conference call at 8:30 a.m. Eastern Standard Time (5:30 a.m. Pacific Daylight Time) on Tuesday, November 7, 2023. Third-quarter results will be released prior to the market opening on November 7, 2023. The financial results will be released by newswire as well as filed with SEDAR. The results will also be available on our website.

Ajay K. Virmani, President and Chief Executive Officer, Scott Calver, Chief Financial Officer, Sanjeev Maini, Vice President Finance, Jamie Porteous, Chief Commercial Officer, and Pauline Dhillon, Chief Corporate Officer of Cargojet will review third quarter financial results and corporate developments.

To participate in this conference call, please dial the following number(s) approximately five minutes prior to the commencement of the call:

Local Number: 416 406 0743

Toll Free Number: 1 800 952 5114

Please reference participant code 5874277#.

Should you be unable to participate, an instant replay will be available until

Thursday, December 7, 2023 by dialing:

Local Number: 905 694 9451

Toll Free Number: 1 800 408 3053

Access Code: 6358139#

For any one-on-one calls please contact Sanjeev Maini to coordinate timing.

We look forward to having you participate in our call.

Pauline Dhillon

Chief Corporate Officer

Tel: (905) 501 7373 or pdhillon@cargojet.com

Mississauga, ON, Sep 18, 2023 – the Board of Directors of Cargojet Inc. has declared a cash dividend of $0.2860 per common voting share and variable voting share for the period from July 1, 2023, to September 30, 2023. The record date for determining shareholders of the Corporation entitled to receive payment of the dividend of the Corporation shall be September 20, 2023, and the payment date for such dividend shall be on or before October 5, 2023. These dividends will be eligible dividends within the meaning of the Income Tax Act (Canada).